Total Cryptocurrency Market Cap Continues to Shrink, Bitcoin Price Heads Toward Sub-US$1900

It is a very rough weekend for cryptocurrency holders,

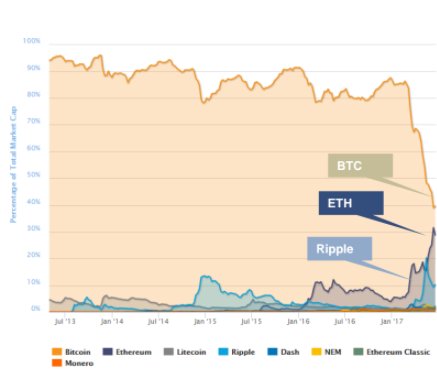

as is to be expected. With the value of Bitcoin going down even further, most other altcoins see similar losses. We also saw both Dash and NEM suffer from their market cap going below US$1bn. Moreover, the total cryptocurrency market cap continues to drop and is on target to go below US$60bn in the coming days.

The Cryptocurrency Downtrend Continues Unabated

Do not be mistaken in thinking we like to report on massive losses in the cryptocurrency world. At the same time, there is no reason to ignore the obvious facts staring us in the face right now either. Cryptocurrency is not in the best of places and the overall downtrend is not over just yet, by the look of things. Bitcoin has dipped below US$2,000, as we predicted in yesterday’s article. We wouldn’t have minded being wrong in that assumption, though. Looking at the current price, Bitcoin is holding its own around the US$1,900 level. That doesn’t automatically mean the price won’t go below that target, though. Rumors and speculation on Telegram hints at how BTC may even hit US$1,400, although that may be wishful thinking at best. There are plenty of people who wouldn’t mind buying some additional bitcoins while they remain cheap. Now is a good price to buy Bitcoin, assuming you expect the value to bounce back over time.

Other currencies are not doing much better either. If the Bitcoin price goes down, the rest of the ecosystem will automatically follow. It is one of those unwritten rules in the world of cryptocurrency. Ethereum lost another 24%, with Ripple putting up similar numbers. Litecoin “only” lost 4% — which is quite remarkable — whereas Ethereum Classic dropped 13.3%. It is quite interesting taking note of these different percentages, even though the overall trend is anything but positive.

As is to be expected, there is always one currency to buck this trend. On this Sunday, that coin is none other than IOTA. Given the recent beating IOTA has taken across the exchanges prior to this Bitcoin drop, the reverse trend is quite intriguing to take note of. Whether or not this momentum can be maintained for the long run, remains to be seen. Most currencies are noting losses of well over 12%, which is quite a bit higher than Bitcoin’s 7% loss. All things considered, Bitcoin is still in a better position than most other currencies, with the exception of Litecoin. The bigger question is why this extended downtrend is taking place right now. The upcoming SegWit2x and UASF activation certainly cause a lot of fear among novice users. Moreover, it appears some exchanges will halt Bitcoin deposits and withdrawals during that period. That is not uncommon by any means, as the risk of a chain split is very real. Halting trading at such a critical point in history is the best course of action and shouldn’t be any cause for concern whatsoever.

If the cryptocurrency market cap continues to shrink at the same rate, we will go below US$60bn very soon. Right now, the total cap is just below US$64bn, which is well below the US$110bn mark we reached a few weeks ago. A correction was bound to happen sooner or later, though. We have seen a lot of money pour into cryptocurrency as of late. Such a massive trend can’t be sustained indefinitely. The markets will bounce back eventually, though, and now is a good time to hold and not look at charts until early August.

Chuck Reynolds

Marketing Dept

Contributor

Please click either Link to Learn more about -Bitcoin.

Alan Zibluk Markethive Founding Member