Ethereum's share of the cryptocurrency market has exploded

Ethereum is gobbling up share in the cryptocurrency market.

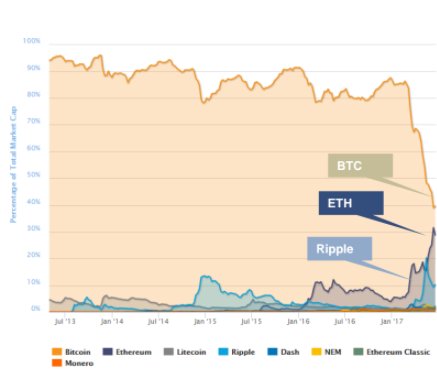

A new report by Autonomous NEXT, a financial technology analytics service, shows that Ethereum's percentage of the total cryptocurrency market has sharply risen since the beginning of the year.

In January it stood at approximately 5%. As of June 22, its marketcap as a percentage of the entire market rose to 30%.

Ethereum's impressive rise has led to a dramatic fall in bitcoin's marketcap as a percentage of the market. It has declined from about 85% at the beginning of the year to just under 40% as of late June. Up until mid June, Ethereum was on track to surpass bitcoin as the world's largest cryptocurrency by market cap, according to Coindesk, but its share of the market has since pulled back.

Still, the shift from bitcoin to Ethereum reflects a change in what the cryptocurrency industry wants from blockchain tech, according to the report.

"Early phase of cryptocurrency market development focused on who will be the “digital gold” — and Bitcoin won through the largest developer and adoption ecosystem," the report said. "However, current battle is for other functionalities, such as global decentralized computing or smart contracts infrastructure."

Ethereum, unlike bitcoin, wasn't built to simply function as a "digital gold." According to Paul McNeal, a bitcoin evangelist, the Ethereum blockchain was built as a platform on which two parties could enter into a so-called smart contract without a third party. As a result, it can be used as a currency and it can "represent virtual shares, assets, proof of membership, and more."

The multifaceted functionality of Ethereum has many folks in financial services bullish on its future. Mike McGovern, the new head of Investor Services Fintech Offerings at Brown Brothers Harriman & Co, is one such person.

"Ethereum is not only cheaper than bitcoin, it is also more robust and has more applications outside of simply financial transactions," he said in a recent interview with Business Insider.

A survey recently cited by Nathaniel Popper in The New York Times indicates that a lot of businesses are singing a similar tune. Almost 94% of surveyed firms said they feel positive about the state of ether tokens. Only 49% of firms surveyed had a positive feeling about bitcoin.

David Ogden

Entrepreneur

Author: Frank Chaparro

Alan Zibluk Markethive Founding Member