Miners Are Milking Bcash’s Difficulty Adjustments

Bitcoin Cash (Bcash or BCH) has been more profitable to mine than Bitcoin (BTC) on multiple occasions over the past week or two. This is creating a new dynamic within Bitcoin’s ecosystem — one which is not really beneficial for either coin.

In Bitcoin Magazine's previous article on this topic, we explained why Bcash mining should normally not affect Bitcoin too much, aside from the incidental higher fees and slower confirmations. We also explained why this dynamic could, in the meantime, ruin Bcash, as it should freeze that blockchain in its tracks.

We also noted that Bcash has a built-in emergency solution to mitigate the risk, which could get its blockchain moving again. But this solution does assume either that some miners are choosing to act against their own short-term interest at certain times for the benefit of all miners — or that miners are coordinating for their mutual benefit, on some level.

Now, several days later, it appears that this is what’s happening. Some miners are either acting against their short-term interests for specific periods of time — or they are coordinating to trigger the emergency solution.

The good news for Bcash is that this means its blockchain is still in motion for now, at least on most days. But at the same time, the dynamic generated by the emergency solution is benefiting its miners overall, more than anyone else — and it’s even calling into question the long-term viability of Bitcoin Cash itself.

The Emergency Difficulty Adjustment

First, a brief recap of Bitcoin mining and Bcash’s built-in emergency solution.

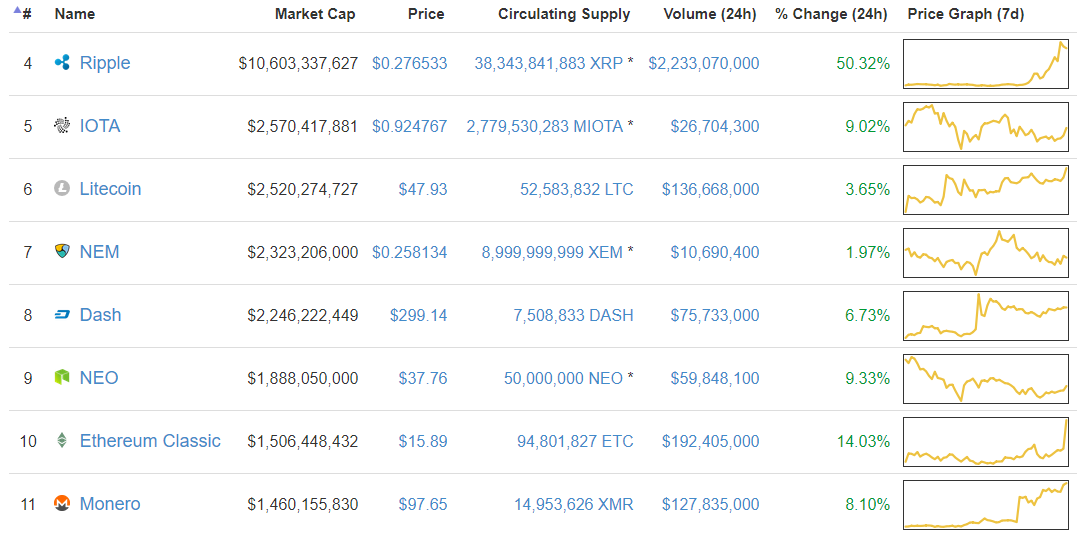

Mining profitability is determined by the value of the block reward (newly mined coins plus transaction fees) and the “difficulty” to mine a block. If the value of the block rewards are higher and the difficulty is lower, miners make more money.

The difficulty on both Bitcoin and Bcash self-adjusts each time 2016 blocks are mined. If it takes longer than two weeks to mine these 2016 blocks, difficulty adjusts downward so it becomes easier to mine. If it takes less than two weeks, the difficulty adjusts upward so it becomes harder.

Bcash really needs its difficulty to be low enough to match the value of its block rewards in relation to Bitcoin. So, if Bcash's block reward is worth 15 percent of Bitcoin’s block reward, Bcash’s difficulty must also be 15 percent of Bitcoin’s difficulty, or lower. Otherwise, Bitcoin will be more profitable to mine, and miners will really have no reason ever to return to Bcash, leaving the Bcash blockchain frozen in its tracks.

The big problem is that, as long as Bcash’s block rewards do not exceed Bitcoin’s block rewards, this is bound to happen sooner or later. At some point, Bcash difficulty will exceed what its block reward will be worth, at which point all miners should leave.

To mitigate this problem, Bcash implemented a feature called the “emergency difficulty adjustment” (EDA). If in a space of at least twelve hours, fewer than six blocks are mined, the difficulty adjusts downwards by 20 percent for the next block. If miners coordinate or time this well, this can bring difficulty down by about 75 percent within a day.

The Problems

While triggering the EDA is preferable over a blockchain frozen in its tracks forever, it does present new problems.

Once difficulty is low enough, profit-maximizing miners are incentivized to jump on Bcash mining, producing an enormous number of blocks before difficulty adjusts within a day or two. Then, once the difficulty adjusts upward by a lot, and all these miners will switch back to Bitcoin — until some miners trigger Bcash’s EDA again, potentially after 12 hours or so, and all miners hop back on Bcash, creating a sort of stop-and-go cycle, on repeat.

In our previous article, we noted that this stop-and-go cycle is not ideal for users. But we didn’t go into specifics about what problems those would be, exactly. And there are a number of them…

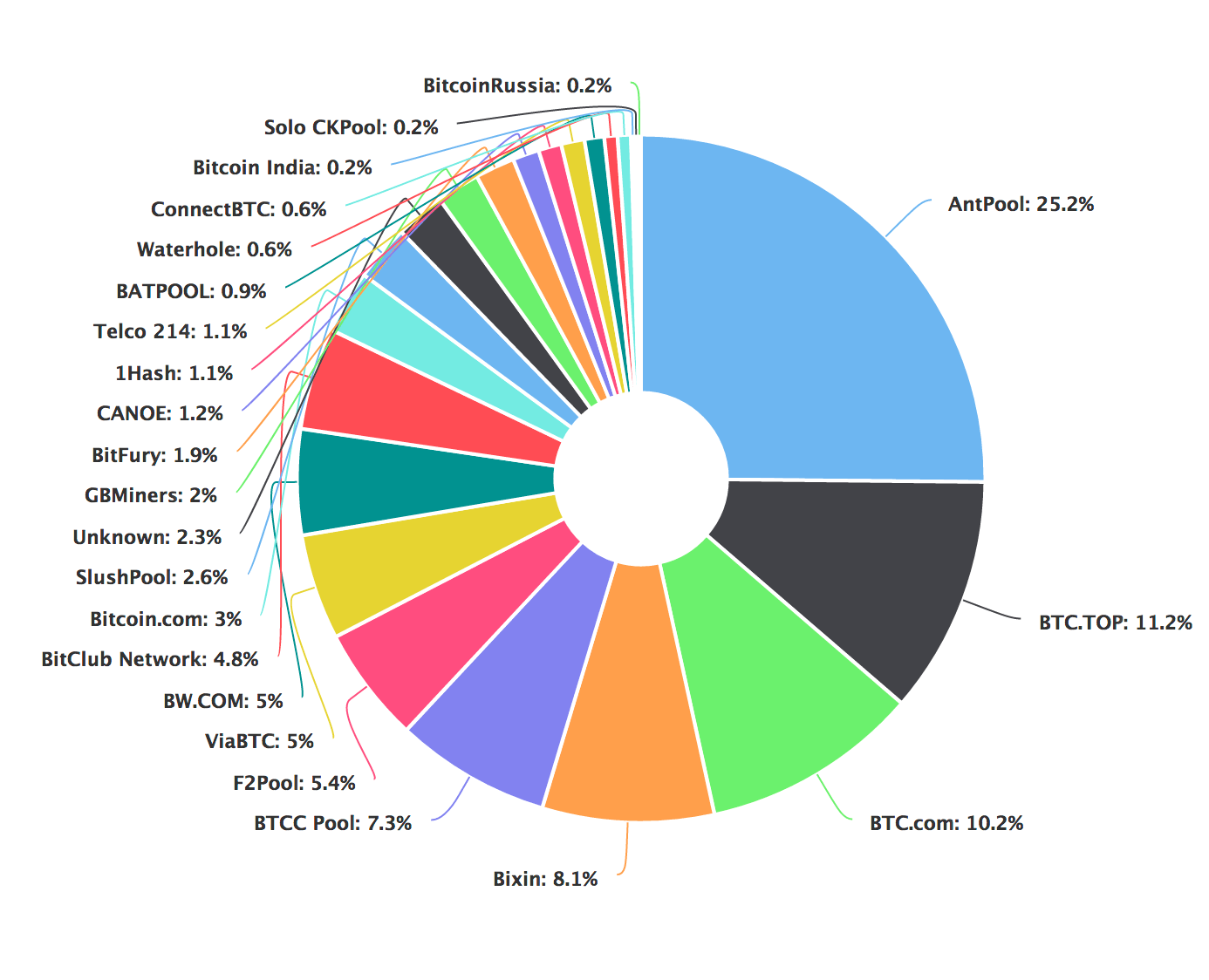

First of all, this stop-and-go cycle actually causes a disturbance for Bitcoin users as well. Each time miners hop on Bcash, hash power leaves the Bitcoin network, which means that Bitcoin blocks are mined more slowly. As a result, Bitcoin’s transaction fees and confirmation times go up. And the fact that miners are intentionally gaming the system like this, suggests that the situation could drag on for a while: potentially weeks or months, and maybe even longer depending on how Bcash develops.

Meanwhile, this cycle makes Bitcoin Cash confirmation times very unreliable. On some days, transactions confirm very quickly, as blocks are found about every minute. On other days, there are (almost) no new blocks at all for at least 12 hours, and transactions take incredibly long to confirm, by comparison.

Arguably, an even bigger problem is that because of this dynamic, Bcash mining rewards — new coins — enter the system much more quickly: currently about four times faster than they are supposed to. As a result, Bcash’s inflation rate is relatively high. While Bitcoin’s current yearly inflation rate sits at about 4 percent, Bcash’s yearly inflation rate is on pace to be closer to 16 percent. This favors miners who earn these coins — at the cost of coin-holders.

What’s more, because of this same dynamic, Bcash’s next block halving will arrive much faster as well, possibly around mid 2018 instead of mid 2020. And if nothing changes, there could even be another halving by early 2019: the block reward could fall to 3.125 BCH in just a little over a year from now.

These halvings is where Bcash’s real problems could begin.

As perhaps its central value proposition compared to Bitcoin, Bcash wants to keep its transaction fees extremely low; even as low as zero. Therefore, it is not clear that fees will make up for the loss in rewards; it seems especially unlikely that these losses will be made up within a year, if ever. So unless the market price of BCH, compared to BTC, increases by a lot, and fast, the value of Bcash’s block reward could dwindle significantly.

Now, keep in mind that for miners to mine Bcash at all, its difficulty must be even lower than its block reward, compared to Bitcoin, and that if that is the case, all profit-maximizing miners are expected to pile on.

That means that all these miners will be able to mine the 2016 blocks even faster when they do all pile on Bcash. Instead of two days, it could take them even one day. Or less. Which would, of course, mean that the next block halving will be reached even faster. This would in turn means that the block rewards would be even less valuable, difficulty would needs to be even lower for miners to hop on, and miners would be able to mine the 2016 blocks even faster next time. Maybe even in half a day.

Bcash’s EDA could lead to vicious downward spiral, which would significantly decrease Bcash’s security against 51% attacks. It would also make it easier for miners hostile to Bcash to frustrate the system in other ways; for example, they could prevent emergency adjustments from kicking in. Moreover, Bcash could reach the point where its block rewards aren’t even worth the time and effort for miners to switch between chains, and Bcash freezes in its tracks, after all.

Bitcoin Cash will need to fix this problem somehow, and by now developers are indeed discussing the issue. Either that, or the coin must become more valuable than Bitcoin to mitigate the problem altogether — fast.

by Aaron van Wirdum

Staff Writer Bitcoin Magazine

Aug 27, 2017 12:46 PM EST

Posted by David Ogden Entrepreneur

Alan Zibluk Markethive Founding Member