Managing Enormous Risk — Bitcoin and Altcoin Investment Strategies

While some have made millions investing in digital currencies, others would call it degenerate gambling. If you’re reading this, then you know how exciting and unpredictable the crypto world is. Fortunes are built and demolished in seconds, new and exciting technology pops up every day, and controversy rules the land. It’s pretty much the Wild West of finance.

The unprecedented growth of cryptocurrencies has attracted investors from all walks of life, many of whom have been enticed by the staggering returns made by early investors. If this sounds like you, then keep reading. Unfortunately, we're not going to teach you how to get rich in a few days; in fact, we're going to try and deter you from that objective.

Not that we don’t want you to be super-rich, don’t get us wrong. But we prefer to have more grounded goals and we want you to do the same. Investment is a tricky game and the patient person usually wins. Avoiding “fear of missing out” (FOMO) is essential, especially in crypto, where disinformation, fake news and drama are commonplace.

So what exactly is the point of this article, you may wonder? Well, today, we want to give new players in the cryptosphere some ideas on how they can begin to navigate the tricky world of investment. We feel this is important due to the growing amount of scams and low quality projects out there.

We’re not saying that the strategies we discuss are foolproof or even profitable. They are not based on any mathematical formula nor were they devised by any experienced investment professional. These are simple ideas that are popular among entrants and old school digital currency investors alike.

It’s important to note that this article is not to be taken as investment advice and that you should always remember the golden rule of investment: Never invest more than what you can afford to lose.

Diversify and play it safe

This is a simple one. If your portfolio only has one coin on it, you’re doing it wrong. Now, we know some people will say Bitcoin is the only cryptocurrency you should own, but at this point it’s safe to say that this is an absurd statement founded on feelings and ideals, rather than actual facts.

Bitcoin is thriving because it is the first and most popular cryptocurrency out there. It has the first mover advantage and it is also backed by an extensive network of miners who keep it safe. In terms of technology or features, however, Bitcoin falls short of its peers. We’re not saying you shouldn’t have Bitcoin, but you should also acknowledge other cryptocurrencies out there.

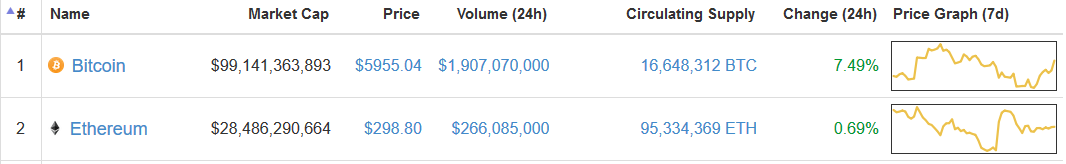

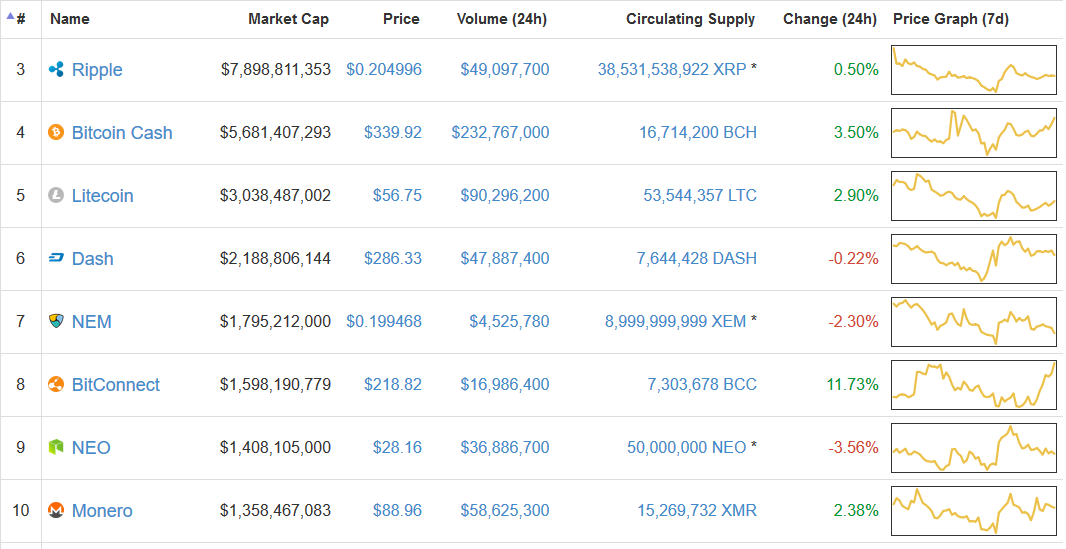

It may be a good idea to play it safe, however, and to “bet” on the most popular coins only, such as the top 10 by market capitalization. At present, those are: Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, Dash, NEM, NEO, BitConnect and Monero.

Bet on the idea, not the project

The world of Blockchain technology has evolved to a point where currency is just one of the many functions a cryptocurrency can have. There are smart contract platforms like Ethereum, NEO and Qtum, there are decentralized storage networks like Storj, Sia Coin and Filecoin and there are decentralized exchange platforms like Waves, Bitshares and others.

Our suggestion is, instead of buying one cryptocurrency in each category, you should spread your investment throughout multiple options inside each category. This will allow you to reduce the risk of investing in one single currency. In the world of crypto, a technical difficulty or even a grievance within one of the teams can lead to an rapid crash in the price, regardless of how promising the project and tech are. Just look at what happened with Tezos.

Hedging

Again, diversification is the name of the game. If you’re in crypto, then you are probably aware of how risky it all is. The cryptocurrency movement could end in days if some major security flaw was discovered or if all governments decided to ban them. The same can happen if some new and improved alternative to Blockchain technology comes along. These are, of course, worse case scenarios that are unlikely but possible nonetheless.

So, if you’re not one to have all your eggs in the same basket, you may want to extend your investment strategy to instruments outside of crypto. Precious metals, stocks, and other traditional investment vehicles may be a great addition to your portfolio and will allow you to reduce the risk you would take by investing in cryptocurrencies only.

Some companies, for example, manage cryptocurrency investment funds that combine cryptocurrency investments with investments in other sectors, like real estate. We talked to Kirill Bensonoff, CEO and founder of Caviar, about the importance of heeding your investment in the cryptocurrency space with traditional instruments.

He stated:

“We found a couple of major issues with crypto-asset investing, namely, it’s difficult and time consuming, and all assets are highly correlated. There is no ‘safety’ asset that also produces an income. We also see a movement towards having crypto be backed by traditional assets, such as gold, real estate and others, and we are addressing this head on.”

Liquidity, liquidity, liquidity

This is something that many new players forget about. You may find yourself investing in a cryptocurrency, having it increase in value several times over, only to realise that you can’t really sell it. If you try to sell large amounts at once, you’ll crash the price. Why? Because there is no liquidity. If a coin has no trading volume, significant price swings are bound to happen.

You can play it safe and avoid low volume coins all together but if you don’t want to, the least you can do is to know the risk you’re taking. CryptoCompare has a portfolio tool that allows you to analyse several risk factors in your portfolio, including volatility, exposure and, of course, liquidity. Their tool allows you to get an estimate of how long it would take to sell a certain coin based on the current volume. We asked Charles Hayter, CEO of CryptoCompare, why this tool is important for entrant users. He stated:

“We want to make it easy for users to track how well they're doing. Crypto is risky in the extreme and we want to help people understand where these risks lie and how to quantify them.”

Room to grow

Remember what we just told you about liquidity? Well, this strategy is somewhat contradictory, but it’s important to note that not all of these strategies are compatible with one another. Also, some involve more risk than others, and this one is risky. So, what do we mean with “room to grow”?

Small market cap cryptocurrencies have more growth potential than the ones at the top. Of course, other factors will determine if the price will rise or not but the idea is that, if you invest in cryptocurrencies before they are big, you may get to see your investment grow several times over.

Now, before you go to the nearest exchange and start stacking up on useless meme coins, have a think about what you want to buy. Then, perform your due diligence, check the roadmap, check the team, read the whitepaper, learn about the technology. Do everything in your power to ensure that your investment is justified. This will also make it easier for you to stick to your strategy, knowing that you are invested in something you believe in.

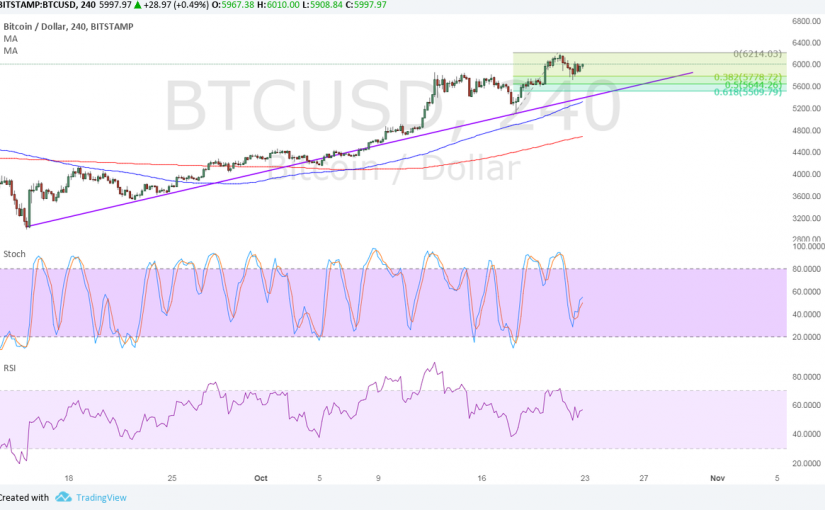

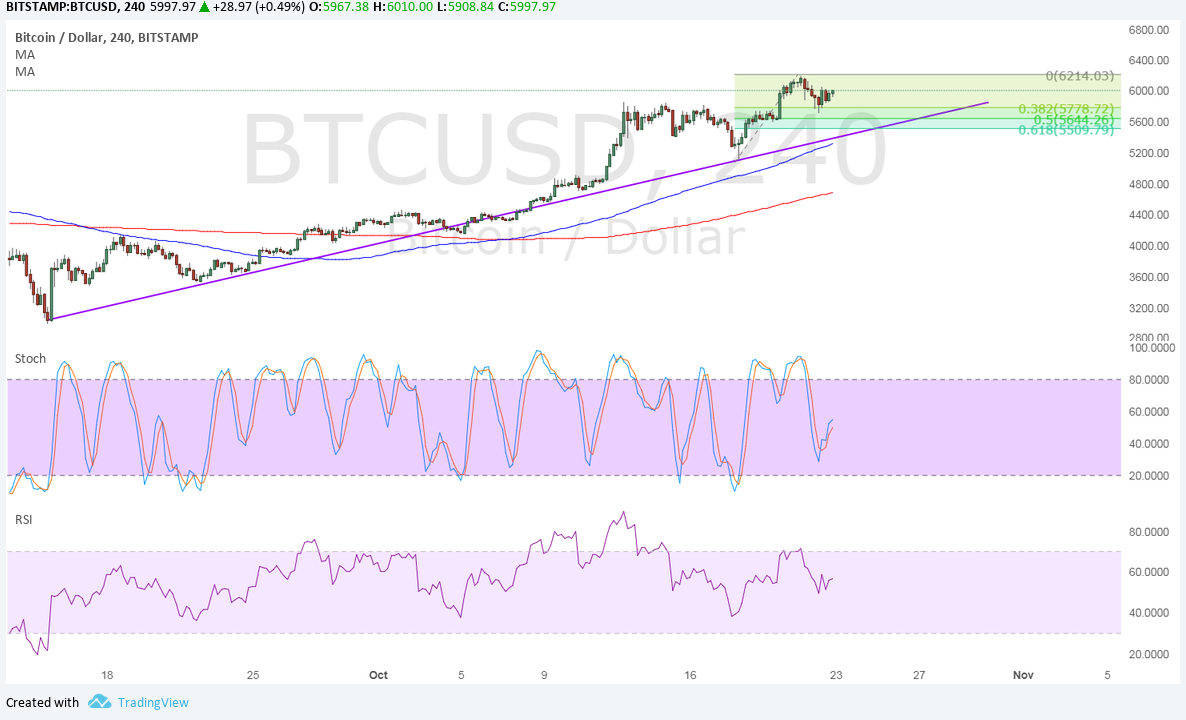

Technical analysis

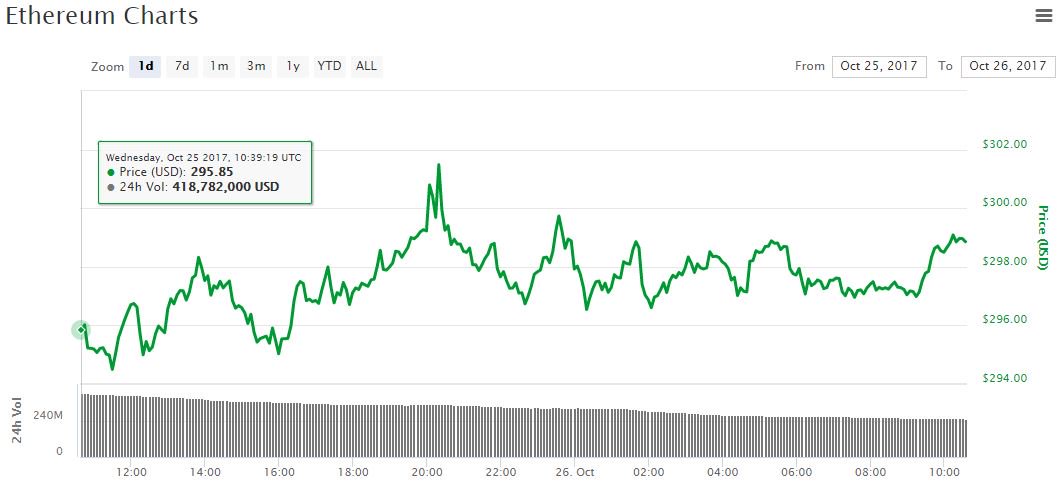

Yes, chart wizardry. To be honest, I have no idea how it works and I admire anyone that does. All those numbers and lines give me headaches. Nevertheless, if you have it in you, learning T.A. can do wonders for your investment strategy even if you only touch the surface! We asked Jonathan Hobbs, CFA and author of the Stop Saving Start Investing: Ten Simple Rules for Effectively Investing in Funds investment book how technical analysis can be useful even for a newbie investor. He stated:

“Any good investment strategy needs rules. Technical Analysis (or “TA”) uses rules to look for price and volume patterns in charts to try and predict what’s going to happen next. It helps investors choose when to buy or sell. One example of TA is the Simple Moving Average (or “SMA”). The 50-day SMA, for instance, is the average price over the last 50 days, which changes or ‘moves’ each day. When an investment starts trading above its SMA, this is could be a bullish sign. Since TA can also protect the downside, it’s a good risk management tool for volatile investments like cryptocurrencies.”

Proof of Stake interest

A lot of people would love to invest in cryptocurrency mining, but at this point, you either go big or go home. Mining has become an industrialized practice reserved only for those with large financial backing, high tech equipment and access to low energy prices. Although there are several alternatives to traditional mining, Proof of Stake is the most relevant one for the subject at hand.

To put it simply, Proof of Stake allows users to “mine” coins without mining equipment. In this system, the amount of coins a user holds will determine how many coins he mines. Although most PoS cryptocurrencies will require you to leave your wallet running, some implementations of PoS like Waves and Lisk allow you to earn interest by leasing or delegating your stake.

Do note that you shouldn’t go out and buy every PoS coin out there. You should, however, check your holdings for these types of coins and, if you have them, mine them! In the worst case scenario, you’ll need to leave the wallet running which can be done with any laptop or even a Raspberry Pi device.

Author: Frisco d'Anconia

Posted by David Ogden Entrepreneur

Alan Zibluk Markethive Founding Member

Low Cost Website Promotion…Why Not?

Low Cost Website Promotion…Why Not?

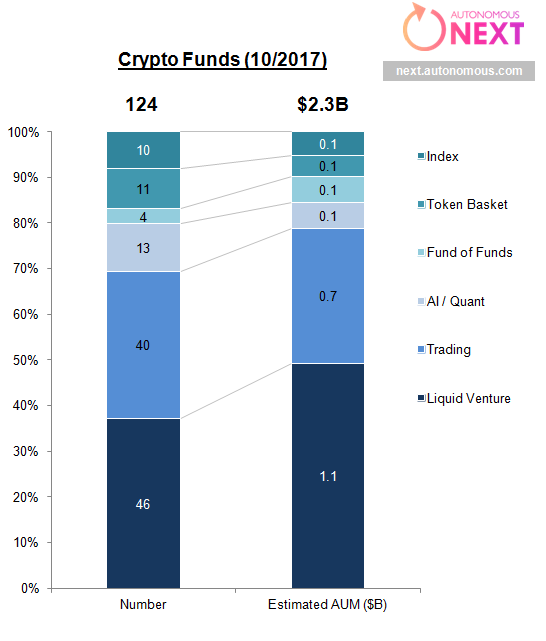

Source: Autonomous Next

Source: Autonomous Next

Hiring a Consultant for Internet Marketing

Hiring a Consultant for Internet Marketing Learning more about Internet Marketing for yourself

Learning more about Internet Marketing for yourself