Everything You Need to Know About Bitcoin

Many netizens have heard of bitcoin, the digital currency. This means it exists electronically. To be more precise, bitcoin is a type of cryptocurrency — the implication of security and encryption is important. Cryptocurrency, or digital currency, is an invention of the Internet. Basically, someone out there thought, "hey, what if…Read more. In this post, we attempt to identify 10 questions about Bitcoins that can give you a clearer understanding of what it is, what it does and how you can use it to buy products or services online.

What are bitcoins?

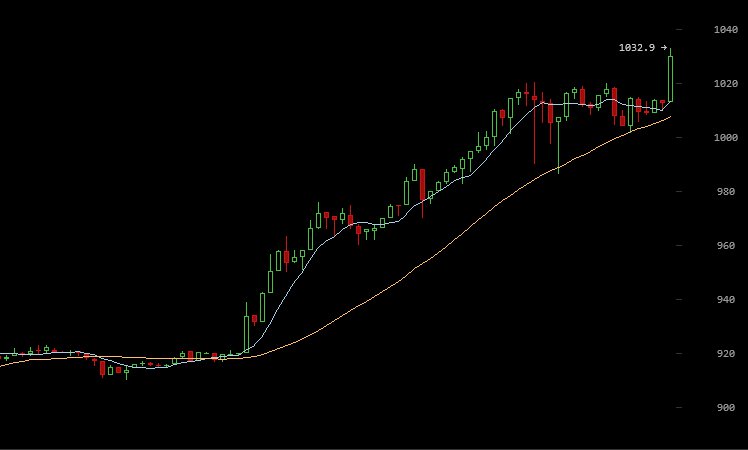

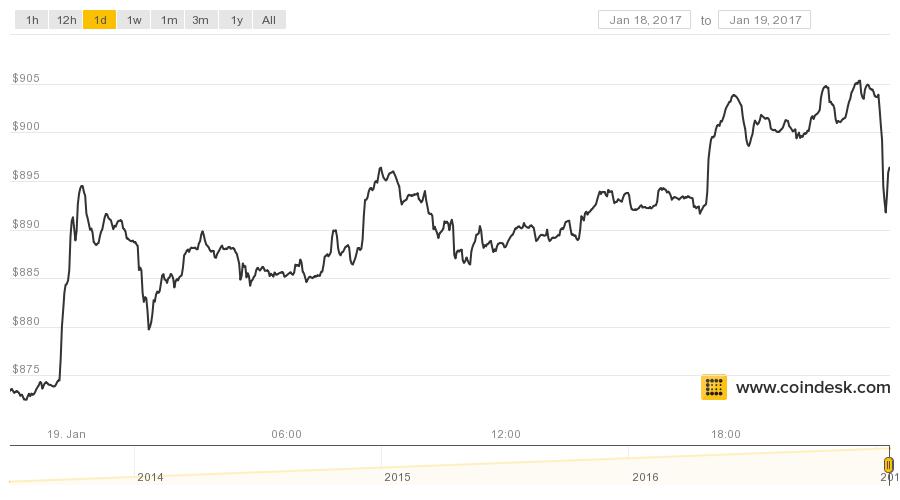

Bitcoin (capitalized) refers to the software or network (ie: the Bitcoin Network), while bitcoin (not capitalized) refers to the digital currency itself (ie: two bitcoins). he price fluctuates, depending on what people were willing to pay for it. It traded for as low as pennies (during the infancy stage) to as high as USD1200 during its peak in 2013.

Who developed the idea of bitcoins?

The idea of Bitcoin was conceptualized by Satoshi Nakamoto, an anonymous figure. In May 2008, he shared a white paper [PDF] about Bitcoin, a peer-to-peer cryptocurrency. Without disclosing who he was, Satoshi outlined how the currency would work: bitcoins would be ‘mined’ by computer software, transferred directly amongst users and recorded in an untamperable ledger without the need of a third party.

Part of Bitcoin’s appeal is Satoshi Nakamoto’s anonymity, who many view as a selfless act towards a new era of financial revolution. Online detectives have identified a few candidates, including a real-life Japanese person sharing the same name. Some even theorized that Satoshi Nakamoto is a pseudonym for a collective.

In May 2016, the Bitcoin community was shocked when Australian entrepreneur Craig Wright identified himself as Satoshi Nakamoto. Some people believe his claim, some didn’t, but on the whole the Bitcoin community is unaffected — the Bitcoin ecosystem is decentralized, and cannot be controlled by any person(s), including the creator.

What is so special about bitcoin?

Bitcoin is a peer-to-peer currency and runs on a system which allows you to send and receive bitcoins without a third party. To put simply, fiat currencies rely on third parties, such as banks or payment processors like Visa, to verify the transaction. This is how you and I can ensure payment sent was indeed received. However, bitcoin transactions are recorded in a public ledger called the bitcoin blockchain. This information are permanent and publicly viewable on Blockchain.info and cannot be edited or deleted.

This means that the transaction records act as proof of transaction. Bitcoin is also programmed to be non-duplicable, which means double spending is highly unlikely.

What is decentralized currency?

Bitcoin is also a decentralized currency, as in no one government, individual or group holds authority over it. This makes bitcoin spendable anywhere in the world as long as the receiver accepts bitcoins as payment.

Decentralised currencies are a unique concept. Similar to the internet, it is free from geographical boundaries — this is why bitcoin is also dubbed ‘the currency of the internet’.

Due to lack of control and regulations, many countries are understandably wary of bitcoin — and other cryptocurrencies in general — but some progressive countries such as Japan have started to recognize it as currency.

Is bitcoin anonymous?

Bitcoin’s anonymity is a myth. Or rather, it is now much harder to make anonymous transactions with Bitcoin. Because as the ecosystem matures, many bitcoin service providers have started implementing KYC/AML regulations. KYC/AML stands for know your customers/anti-money laundering . This requires users to submit proof of identity and proof of residence.

It is also fairly easy to trace bitcoins. Bitcoins are usually bought from bitcoin exchanges, received as payment, or donated. With transaction details publicly viewable online, it is possible to trace where the bitcoin came from.

How do you use bitcoins?

Bitcoin can be used for spending, similar to money. Some people also keep them for investment purposes, while others prefer to use them as a method to make international money transfer. Bitcoin exists electronically and is kept in ‘bitcoin wallets’. There are many types of bitcoin wallets: desktop wallet, mobile wallet, online/web-based wallet, hardware wallet and even paper wallet.

To read more about bitcoin storage, check out this article by CoinDesk. You can have as many wallets and bitcoin addresses (where you receive money from others) as you like.

How many people are using bitcoin?

Estimates vary — it is hard to find out the exact number of people who use Bitcoin. One way to measure number of bitcoin users is by measuring the number of bitcoin wallets. According to CoinDesk’s State of Bitcoin and Blockchain 2016 report, bitcoin wallets doubled to 12.77 million in one year, from the end of 2014 to the end of 2015. Even though many bitcoin users have more than one wallet (it is common to hold a few wallets), this is an indication that the number of bitcoin users worldwide is increasing.

Another way to estimate bitcoin usage is by the number of bitcoin transactions, which has steadily increased. Although this could mean that the same people are simply making more bitcoin transactions, it is fair to assume that there are new bitcoin users in the mix, too.

How do I acquire bitcoins?

There are three main ways to get bitcoins: mine them, buy them, or work for them.

Bitcoin Mining

Bitcoin mining used to be really profitable. However at the current time it is no longer cost effective for the average individual. One will need to buy specialised Bitcoin mining equipment, get/rent dedicated spaces for them, and pay their associated costs (rental, electricity and cooling costs).

Buy Bitcoins

You can buy bitcoins from many online exchanges. There are a lot more options now than ever before — there are global bitcoin exchanges and also country-specific bitcoin exchanges. You can also buy them from other people via Localbitcoins.

Work for Bitcoins

Some people get paid in bitcoins, instead of cash currencies. Websites such as XBTFreelancer… and Coinality list jobs with bitcoin payments.There are other less effective ways to acquire bitcoins. You can get (very) small amounts of bitcoins from bitcoin faucets, which pay you to look at advertisements. You can get them as donations. There are also bitcoin ‘investments’ but if you wish to not lose money, Badbavoid companies that are listed in itcoin Badlist.

How do I send/receive/spend bitcoins?

Bitcoin wallets come with bitcoin addresses, which represent a destination, similar to an email address. Bitcoin addresses are alphanumeric, between 27-34 characters in length. Many bitcoin service providers have user-friendly user interface which allows users to generate bitcoin addresses, send and receive bitcoins.

To send bitcoins, users simply have to ensure positive balance in their bitcoin wallets, insert the receiver’s bitcoin address, and hit send. There is a small miner’s fee to process the transaction — miner’s fees are given as a reward and incentive to Bitcoin miners for maintaining equipment. Bitcoin transactions usually take less than an hour to arrive, but it can take longer or shorter depending on the fee amount and the bitcoin service provider.

You can spend bitcoins anywhere that accept bitcoins as payment. You can also use a Visa/Mastercard-linked bitcoin debit card issued by companies like Wirex or Coinbase.

What are bitcoin’s disadvantages?

Depending on who you ask, you’ll get different answers. Coders and programmers might argue that bitcoin is already an outdated network, compared to some of the newer cryptocurrency networks available. Here we will concentrate on bitcoin’s disadvantages to the casual user:

Advanced digital knowledge is necessary

Bitcoin can be stolen in many ways. It is the bitcoin owner’s responsibility to keep them safe, and this meant implementing additional layers of security such as 2-factor authentication. Keeping them in web wallets can be dangerous. If you have a significant amount of bitcoins, you are advised to keep them in hardware wallets such as Trezor or Ledger.

Bitcoin service providers can be hard to trust

The biggest names have failed the Bitcoin community. Who can forget the Mt. Gox incident in 2014. It was the biggest bitcoin exchanger at the time and practically disappeared overnight along with almost 745,000 bitcoins. More recently in 2016, thieves stole almost 120,000 bitcoins during the Bitfinex hack — and experts still don’t know how they did it.

Lack of acceptance

Cold hard cash is still the widest and most used form of payment — it’s acceptance is second to none. By contrast, bitcoin is only accepted at a handful of shops. However, bitcoin debit cards help to address this issue — linked to payment processors, they help make bitcoin spending a bit easier.

Lack of protection

In general, bitcoin is not considered legal in most countries around the world. Therefore, theft or scam victims have almost no option for recourse. However, the legal landscape is ever-changing and one of the best spots to update yourself on where bitcoin is acceptable or not is Bitlegal.io.

Anti-bitcoin politicians

While many countries around the world mainly cautioned the public against the risky nature of Bitcoin, some politicians or political parties have extreme views about bitcoin. Russian and French lawmakers are considering banning it altogether.

Wrap Up

Bitcoin is cool, but the underlying technology behind it — the blockchain — is even cooler. Turns out, having a method to record data in a way that cannot be tampered or deleted is a good thing. It is also a cost-effective method to store information. Many companies including major banks have expressed interest in the blockchain technology.

David Ogden

Entrepreneur

Alan Zibluk Markethive Founding Member