Bitcoin as Trend Setter:

Warren Buffett on Why Money Management is

Expensive & Inefficient

Increasing ambiguity in the structure of the financial industry and rapidly changing trends in investing are bringing more attention towards Bitcoin, the digital currency which traders and investors are using to avoid economic instability and financial uncertainty. Both financial and technology corporations are also actively investigating the potential of Bitcoin’s underlying technology — the Blockchain — in creating a secure, efficient, transparent and cross-sector platform for the settlement of transactions and assets.

However, still, the vast majority of investors and traders are eying potential investments in Bitcoin, possibly through fully regulated and liquid financial instruments such as the Winklevoss twins’ Bitcoin ETF. As Cointelegraph reported, the March 11 approval of the Winklevoss twins’ COIN ETF is nearing and analysts are quite optimistic towards its approval. Once approved, the ETF will open a new market for Bitcoin, encouraging hedge funds and large-scale investment firms to enter.

Warren Buffett says investors always try to beat market,

Bitcoin is a trend setter

Warren Buffett, a prominent American investor with a net worth of $76.1 bln, recently wrote to the shareholders of Berkshire Hathaway in his annual letter that wealthy investors should be able to afford superior financial services. In the letter, Buffett also mentioned that investors and traders are always trying to beat the market, as breaking the trend and investing in innovative companies often lead to the highest profit margins. Buffett himself is known be an early investor in some of the most wildly successful conglomerates, most notably the $183.7 bln beverages company The Coca-Cola Co.

To beat the market and make profitable investments, a high level of risk is involved. More to that, financial managers, investors, and hedge funds maintain a massive portfolio of investments that require immense labor. Thus, hedge funds and investment firms have been charging high fees to their clients for managing their funds. This trend, which has sustained its stability for decades, is starting to change. Hedge fund managers like Paul Tudor Jones, who was known to the financial industry for charging some of the highest fees to his clients, have been continuously decreasing fees over the past few years.

Why Bitcoin matters

and money management will continue to see declining fees

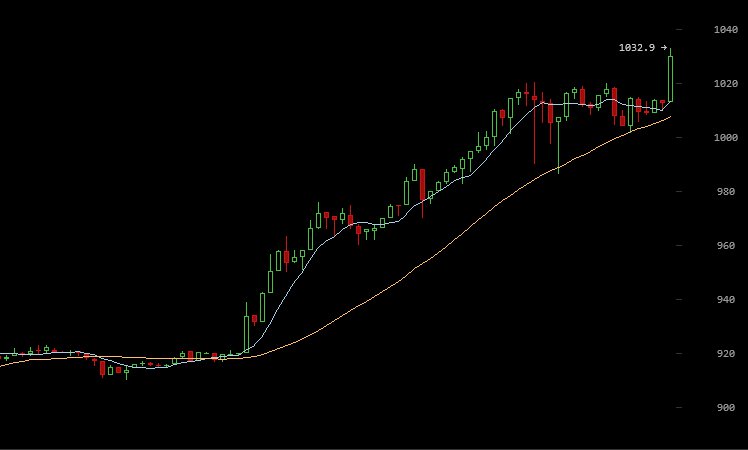

Essentially, the decline of money management fees and the sense of urgency of hedge funds managers all boil down to acknowledging new trends in the market. Over the past few years, Bitcoin has consistently been the top performing currency and assets across all markets and industries across the world. In fact, many mainstream investors, traders, and analysts in early 2017 recognized Bitcoin as the best performing asset and currency throughout 2016, offering extensive media coverage and comprehensive review of Bitcoin as an investment. As a result, Bitcoin’s market cap is continuing to reach new all-time highs.

In the near future, investors will be left with two choices: leave their money with expensive and inefficient hedge funds or invest in emerging assets or currencies like Bitcoin. The choice to invest in Bitcoin will be readily available once the Winklevoss twins’ ETF is approved.

Second Blockchain Academy Launched in Kerala, India

Kerala is to become the second Indian state to get its own Blockchain academy in a joint scheme between the Indian Institute of Information Technology and Management-Kerala, hereinafter IIITM-K and international learning and business development platform Blockchain Education Network, hereinafter BEN. The initiative was announced a recent Blockchain workshop held by the IIITM-K in Kerala’s capital Thiruvananthapuram, with director Dr. Rajasree MS confident of its potential. “Banking, health care [sic], and governance are the three major avenues where Blockchains [sic] will find applications,” he said quoted by Indian Express Sunday.

Professor S Rajeev, a consultant at Maker Village, a subsidiary incubator run by IIITM-K, added that “Blockchain [sic] technology, which leverages the idea of a distributed and decentralized ledger, will open up new avenues both in the software and hardware sectors.” The focus of such ‘academies’ in both Kerala and pioneer Bangalore remains somewhat vague but points to a desire to understand the impact of technology on various spheres of the economy. At the same time, India’s central bank last week suggested Blockchain becoming mainstream was a “pipe dream” and that such technology could only gain popular acceptance with the endorsement of authorities.

Chuck Reynolds

Contributor

Alan Zibluk Markethive Founding Member