“We’re dangerously close to what could be the death of bitcoin,” said bitcoin developer Andrew DeSantis over the weekend after he posted a tweet storm Friday that set off alarm bells for many in the community. What triggered the widespread panic was the possibility that the network would be controlled by an oligopoly rather than held in an equilibrium of competing interests. From Thursday to Saturday, the value of bitcoin dropped 25%, though it has recovered somewhat to 15% below. That day, Vinny Lingham, an entrepreneur in the space known for his price targets, said, “The smart money left three days ago.”

The alleged bad actors maintained innocence.

“I think it’s conspiracy theorist stuff,” said Roger Ver, one of the most vocal advocates of a new version of the bitcoin software called Bitcoin Unlimited that, if it gains sufficient control of the computing power in the network, could become the main version of bitcoin and be incompatible with previous versions. (Ver is nicknamed Bitcoin Jesus because of his history evangelising bitcoin.) His fellow Bitcoin Unlimited supporter, Jihan Wu, the co-founder of bitcoin chip manufacturer Bitmain, said by phone from Beijing, “Definitely, I don't have such kind of plan.” Whether or not the conspiracy theories are true, over the weekend, what has so far been a two-year-long he said-she said stalemate turned into an incredibly expensive game of chicken.

What They’re Fighting About

The crisis has its roots in a two-year-old debate over how to scale the network, which currently accommodates, on average, about a handful of transactions a second, based on a data cap of 1MB roughly every 10 minutes. On the surface, the argument is that some participants in the ecosystem want to raise that limit, called the block size, to what, under Bitcoin Unlimited, would be a flexible cap, while the developers who have been designing and maintaining the software for the last several years, a team called Bitcoin Core, want to keep the 1MB limit but make the system more efficient so it processes more transactions per block.

The argument stems from philosophical differences. “At the highest level, there are two camps that see bitcoin becoming two different things: digital gold or electronic cash,” says Adam White, head of GDAX, the professional trading platform of one of the most well-known startups in the space, Coinbase. “Neither is right or wrong. They’re just different perspectives on what the network can become.” The developers’ approach is one more of digital gold — not necessarily putting every coffee payment onto the bitcoin network itself, but having them processed by other, faster networks that would later connect to bitcoin’s to provide finality to the transaction. Bitcoin Unlimited’s vision, supported by a number of miners at this point, is of bitcoin as e-cash — a network that has room for every morning coffee to be processed on bitcoin’s network, which would, incidentally, give them more transaction fees.

However, what might, in the abstract, be called a philosophical disagreement has become, on the ground, an all-out power struggle.

To understand the fight, it helps to know the game theoretic aspects of bitcoin. Bitcoin miners are people and companies with computers that process transactions for the network by adding them to the blockchain, or the ledger of every bitcoin transaction since the network launched in January 2009. Miners are motivated by a payout that the bitcoin software makes as it mints new bitcoin with every block of transactions processed. (This so-called block reward is currently 12.5 bitcoins, or about $13,750 at press time.) In addition to newly minted bitcoins, miners also receive small transaction fees paid by every user sending bitcoin. Wu is involved in mining in two ways: He not only manufactures bitcoin mining chips through Bitmain but also runs the biggest bitcoin mining operation called Antpool.

Designing the game, and the incentives in it, are the developers. Their motivations can range from ideological to technical. Many developers simply want to see a decentralised financial system not controlled by one or a few entities, whether it’s a government or a few big miners. But they need the miners. Without miners, the network wouldn’t exist, and without enough of them, it’s not secure. However, if too few of them dominate, then the delicate balance of no one party fully controlling the system falls apart since mining would be run by an oligopoly. Conversely, if the developers don’t do enough for the miners, the miners can retaliate against the developers.

Because of the developers and the miners both needing each other and have opposing incentives, they don’t fully trust each other. “Bitcoin is one of those things where nobody wants to be seen as controlling it,” says DeSantis. The magic of bitcoin has been the ability for various players with opposing interests to engage in a system that has so far led to an optimal outcome for all of them.

There’s one last group important to the game theory of bitcoin, but before we get to them: The detente between the two sides has lasted for a few years because the people who support bigger blocks (now in the form of Bitcoin Unlimited) had too little computing power on the network to take control of it. Also, certain technical upgrades, including a block size increase, require what’s called a hard fork, which runs the risk of creating two versions of bitcoin if not done with the full support of the community. Many consider this type of hostile hard fork a potential nuclear option in bitcoin — one that could destroy, or at least damage, the industry that, until last Thursday, had a $20 billion market cap.

From Impasse To Panic

On Friday, several exchanges announced that, in the event of a fork, Bitcoin Unlimited would not have the ticker symbol BTC. They were effectively preemptively awarding Bitcoin Core the reputation of being “the true bitcoin.” Many people in the community thought that that would deter Bitcoin Unlimited from forcing a hard fork.

But alarm spread when, later that day, DeSantis posted a 28-point tweet thread pointing out that Wu would soon be launching new facilities that would bring a lot more computing power to the network. (One deal was for U.S.-based facilities with John McAfee’s company MGT set to launch in the second quarter of 2017 and called MacPool.) While that wouldn’t necessarily give Wu or his companies more than 50% of the computing power, the worried developers hypothesized that since Wu’s company Bitmain manufactures the mining equipment that many miners use, purchasers of his mining equipment might feel pressure to support Bitcoin Unlimited so as not to have their supply of mining equipment cut off in the future. That could then tip Bitcoin Unlimited over the threshold that could allow them to, essentially, create a new version of bitcoin that cut off control from the current group of developers, which would then put the Bitcoin Unlimited developers in control and, at the very least, sow confusion in the market about which was the “true” bitcoin, if not make their version of it the dominant one.

The clincher? Bitmain owns BTC.com, and Ver controls Bitcoin.com. DeSantis asserts that, through search-engine strategies, Wu, Ver and their affiliates could lead many newcomers to believe that Bitcoin Unlimited is the “true” bitcoin. (The MacPool website, currently under construction, sports a ticker provided by Bitcoin.com; Ver is an advisor to MGT.)

As DeSantis puts it, “Most of the hardcore Bitcoiners are not good at talking to the press. They’d probably try to tell you about how the code is not the same and they’d go into some mathematical stuff and it would be a nightmare. You’d have a bunch of guys walking around, talking about math, and then other guys” — Wu, Ver, Bitcoin Unlimited — “saying, ‘We’re Bitcoin.com. Use Bitcoin.’” (DeSantis also notes that McAfee has been accused of murder and Ver is a convicted felon.)

In response, the Core team, DeSantis and other bitcoin developers are contemplating their version of the nuclear option: that they change the Bitcoin software so that it no longer works on the hardware currently running it. It would be as if Microsoft decided to change Office so that it no longer ran on PCs, rendering an entire industry useless. (Such a move would hit Wu, as both a manufacturer of the equipment and a mining pool operator, doubly hard.) But Eric Lombrozo, a Bitcoin Core developer, says, “I’d rather that not happen. I think it’d be dangerous for the network to go down that route. It’s basically a warpath…. But all the players have to consider that these things might actually happen.”

The Defense

Both Ver and Wu deny that they plotted to bring online new mining facilities that would force a fork to Bitcoin Unlimited and then push that as the “true” version of bitcoin. Their criticisms of Core are somewhat similar: Both are unhappy that the team has ignored what they believe is a need for bigger blocks, and both have personal gripes about the developers.

Ver says that Core is ignoring very real problems that currently exist on the network that not only slow transaction times but therefore make transactions less safe altogether. He also says that they treated “horribly” several developers who had been deeply involved in developing the protocol when they advocated for increasing the block size.

Wu thinks that Bitcoin Core’s current proposal to make the network more efficient (for technical reasons, called SegWit) is good technology that solves a number of problems. However, he is angry that about a year ago, a number of Core developers and miners came to an agreement in Hong Kong to adopt both SegWit and a small block size increase. Since then, the developers have proceeded with what they wanted — SegWit — but not the bigger blocks the miners desired.

(Calling the Hong Kong agreement “a diplomatic failure” and “botched,” Lombrozo wrote in an email, “The agreement was not signed by the Core team as a whole…it was signed by a few individual contributors and many of us felt that not only was it impossible to deliver what was expected but that it was contrary to the philosophical underpinnings of Bitcoin. … Ultimately, protocol changes cannot be negotiated behind closed doors by small numbers of people.”)

As for theories that purchasers of his mining equipment would feel pressure to support Bitcoin Unlimited, Wu says, “We have to look at the facts — whether I have ever done this to my customers before. No, I have never. Because the customers give us money to buy equipment. Maybe I can talk to them, maybe I can convince them about what is the best interest of bitcoin miners, but I never force them to do anything because that is anti-bitcoin.”

He also notes that some of the computing power in the new mining facilities will mostly be rented out to other miners (10% of the Chinese facility will be controlled by Bitmain) and so those miners, and not Bitmain, will choose whether to run Bitcoin Unlimited or Bitcoin Core on their individual machines. However, despite a March 1 press release announcing MacPool would go online in Q2, he could not give a launch date for either facility and said both were delayed.

When asked about the possibility of the Core team changing the software so it no longer works on his mining equipment (which involves changing something called the proof-of-work, or POW, algorithm), Wu, who first learned about bitcoin in 2011 and launched his company in 2013, said he remembers the first time he heard this threat in a chat forum in early 2016: “I was astonished. Switching the POW algorithm of bitcoin was never the kind of idea you can think of. If someone disagrees with you, you decide to what? I decided this was very political and was about interests, it’s not only about engineering. If it was only an engineering debate, it would not escalate to this level.” His conclusion: “Since they are doing such threatening, I think it’s OK that we run another kind of software, Bitcoin Unlimited.”

Wu says if Bitcoin Unlimited gets enough network power, the fork will occur. This could create two coins — one with less value than the other, as happened last summer when the Ethereum network split into two, creating Ethereum and Ethereum Classic, the latter of which is worth a fraction of Ethereum even though it is technically the original chain. When asked why he would be willing to risk losing what could potentially not only be a huge sum of money but his entire business, Wu says, “I will reject your assumption” — meaning, he refused to even entertain the possibility that Bitcoin Unlimited would become the chain of lesser value.

Hypothetically, the final touches on the Bitcoin Unlimited nuclear option would be if, after the fork, Bitcoin Unlimited allocated some of its computer power to attacking the other chain so that it was unable to function properly. It would be possible technically since, in order to fork, it would need to gain 80% of the computing power, which means the other side would have a fraction right after the split. (Unlimited has ramped up steeply, rising from about 20% to 37% share over the last month, while Core fell from 80% to 62%. Another miner today announced support for Unlimited.) When asked if Wu would undermine Core, he wouldn’t rule it out: “It may not be necessary to attack it. But to attack it is always an option.” Another way of harming Bitcoin Core would be if supporters of Bitcoin Unlimited dumped all their Bitcoin Core bitcoins, driving down the price for Bitcoin Core coins.

Meanwhile, the Bitcoin Core developers and DeSantis say they are working on a compromise to prevent the various nuclear options. Wu declined to comment on whether he is currently negotiating with anyone. However, just in case, Core is working on new versions of the software that wouldn’t run on current mining equipment.

The Way Forward

Back to our game theory analysis: The last group with an interest in bitcoin are the users, whose motivation is to make bitcoin transactions. (Note: exchanges have a role too, but they will ultimately follow the market, hence, for this discussion, we’ll lump them in with the users.) The way in which the network accommodates more transactions may be immaterial to many of them, making them neutral on the e-cash vs. digital gold question. However, their power over the system is economic: If, say, two versions of bitcoin came out — one that reflected the miners’ preferences and one that reflected the developers’ — the one that would prevail (or at least dominate, if both continued to exist) won’t necessarily be the one that the majority of miners support even though that network might be more robust. Nor would it necessarily be the one that the majority of developers support, even though that network might be perceived as being more technically sound or more decentralised. It would be whichever one the greatest number of investors put their faith in.

Wu suggests a futures contract to determine what the market response would be before any nuclear options are pursued. One currently on offer on cryptocurrency exchange Bitfinex shows Bitcoin Unlimited having a fraction of the value of Bitcoin Core. But Wu says the contract is not structured correctly and instead suggests one with three possible outcomes: Bitcoin Unlimited after a fork; Bitcoin Core after a fork; and Bitcoin Core as it is now, no forks. (The current contract could be lumping together the latter two possibilities into one.)

Whether this death match ends in disaster or a truce remains to be seen. After all, Bitcoin's "death" has been pronounced many times. However, while Bitcoin’s price has been seesawing, the value of Ethereum has more than doubled in the past two weeks and quadrupled since January, giving it a market capitalization of almost $4 billion. Bitcoin’s has now risen to $18 billion by press time, though it was as low as $15.5 billion on Saturday. Still, many cryptocurrency traders talk of what they foresee as “the flipping” — the moment when Ethereum’s market capitalization surpasses that of bitcoin’s. Some industry players surmise that if bitcoin underwent some fiasco around the same time Ethereum gained more validation, the two market caps could cross and never reverse. (Bitcoin's block size debate may have also gotten at least one Ethereum developer contemplating reducing the reward to their miners.)

Lingham no longer even cares about DeSantis’s theory that Wu, Ver, McAfee and company planned to use their new mining facilities to force a fork to Bitcoin Unlimited. “I don’t want to delve into the details of whether this is true or not,” he says. “It’s irrelevant. The point is … this should not be possible in bitcoin.”

Despite the bitter grudges held on both sides, multiple sources said that they thought the most likely outcome was that no hard fork would occur. “My suspicion is these people aren’t dumb enough to try to actually, in such a public way, get control of bitcoin because they know it would lead to a big price drop in general, no matter how good the outcome was,” says Peter Todd, a bitcoin protocol researcher who is aligned with DeSantis and Core. “I think the most likely scenario is that nothing will happen. I really mean nothing.”

Chuck Reynolds

Contributor

Call it the schadenfreude trade.

Call it the schadenfreude trade.

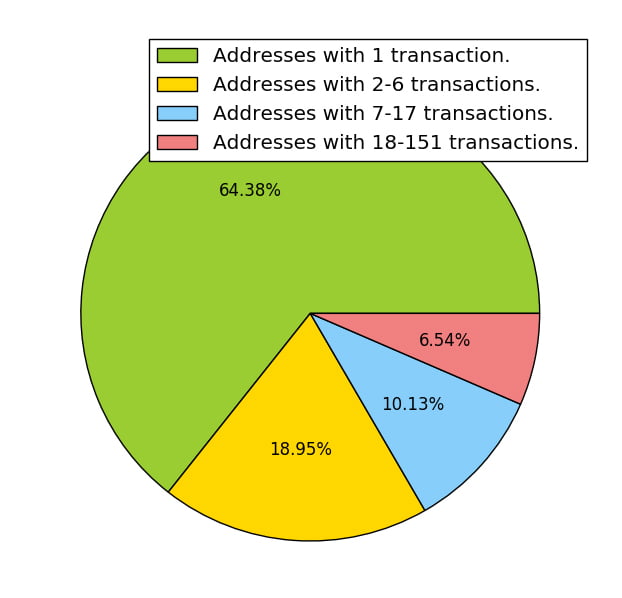

Histogram of the 50 most recent transactions emanating from Bob & Company. The y-axis represents the number of contributors, colleagues of Alice. The x-axis represents calendar days. The regular periodicity of payments to approximately the same number of addresses indicates behavior characteristic of remuneration.

Histogram of the 50 most recent transactions emanating from Bob & Company. The y-axis represents the number of contributors, colleagues of Alice. The x-axis represents calendar days. The regular periodicity of payments to approximately the same number of addresses indicates behavior characteristic of remuneration.

The median transaction value in Bitcoin sent over the lifetime of the address. Note that as the Bitcoin price increases relative to the United States, the dollar value of transactions emanating from Bob & Company is decreasing in rough proportion.

The median transaction value in Bitcoin sent over the lifetime of the address. Note that as the Bitcoin price increases relative to the United States, the dollar value of transactions emanating from Bob & Company is decreasing in rough proportion.