TRANSFORMATIONAL CHANGE IN A

DIGITAL UNIVERSE

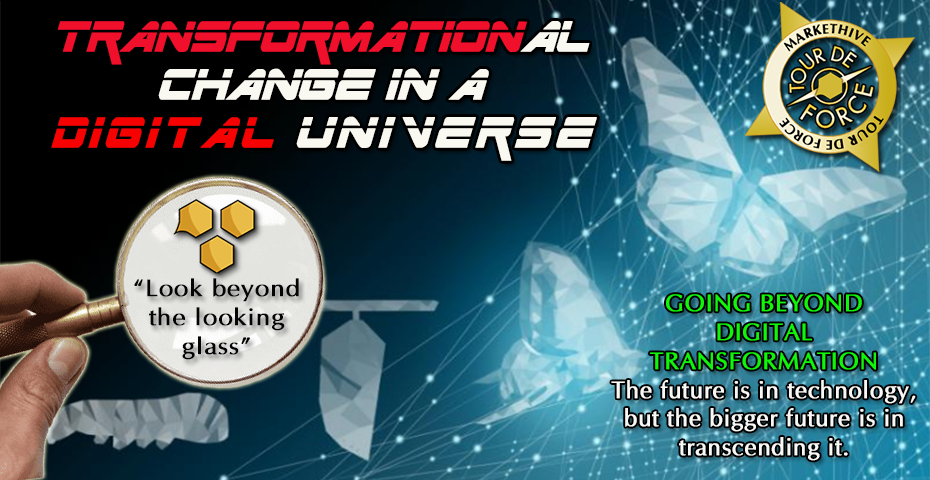

GOING BEYOND DIGITAL TRANSFORMATION. The future is in technology, but the bigger future is in transcending it.

Right now we are experiencing exponential change with the term Digital Transformation re-emerging to what was a fuzzy and undefined topic where many talked about it but didn’t really understand its true meaning or purpose, to a newer more holistic model that is imperative for sustainability and going forward with purpose in this digital world.

The word Digital in this context can be considered as a synonym for the pace of change occurring in today’s world driven by the rapid adoption of technology. Existing companies are put under tremendous pressure making many of them irrelevant as they are not keeping up with the changes. Because of rapid technology adoption, companies need to change how it operates to be able to create and sustain a competitive advantage of how users engage within the system.

There are two different types of organizations — Those that are just doing digital, and a new kind being digital innovators. These digital innovators are way out in front as they are disrupting every sector of the marketplace that is enabled by this new technology adoption. The mistake many companies are making is they are just digitizing existing services or simply adding the technology and calling it digital transformation, but that’s not what digital transformation is now.

Free here : Click here

So What Is Digital Transformation?

Digital transformation was previously understood to be when a company went paperless, or when a brick and mortar company gets a website or starts a Twitter account, but it’s much more than that now.

Digital transformation is a journey of strategic, planned organizational change that starts by empowering individuals and teams with new methods to create highly responsive strategies that are predominantly data-driven and a courageous culture of innovation.

It is the right leadership that creates a high performing, innovative organization that is delivered by marketers and technologists primarily. It is transforming innovation, teams, and culture enabled by technology allowing collaboration, new levels of efficiency, and adding more value to users’ interactions and engagement.

Free here : Click here

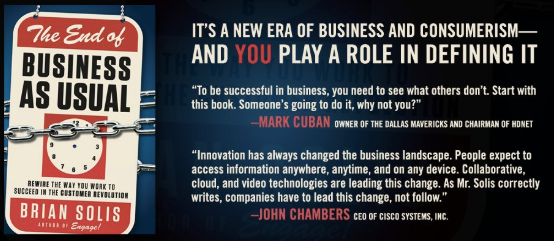

Image credit Brian Solis

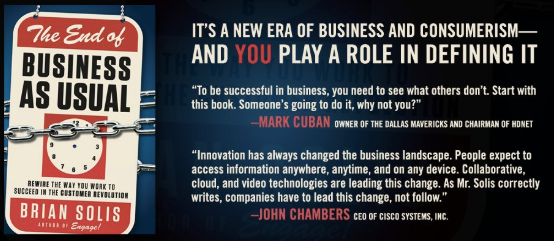

“Business As Usual” Is No More

Once upon a time, “business as usual” was often good enough, but now with technology advancing exponentially, “business as usual” is dead. In a world where everything is connected, considered to be equally excellent and performance is reaching perfection, the biggest innovation is yet to be realized. We as human beings are the central point fuelled by digitization, mobilization, augmentation, disintermediation, automation, and more.

The way we work will never be the same and the skills we need will be dramatically different. So how do we discover new opportunities in one of the most transformational times in human history? Are you driving change or are you being driven by it?

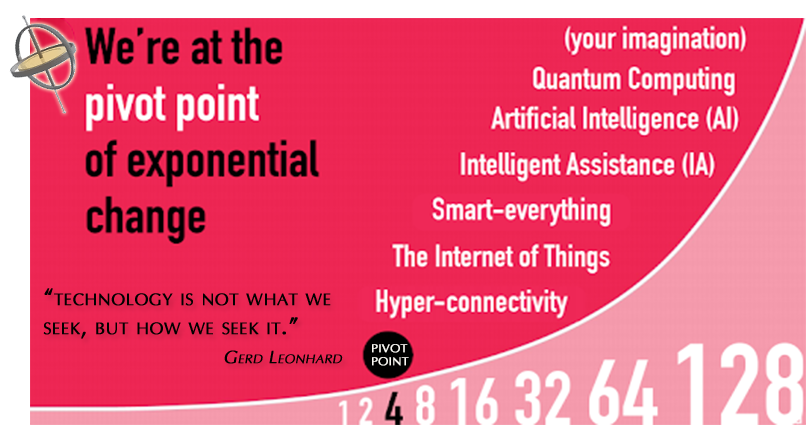

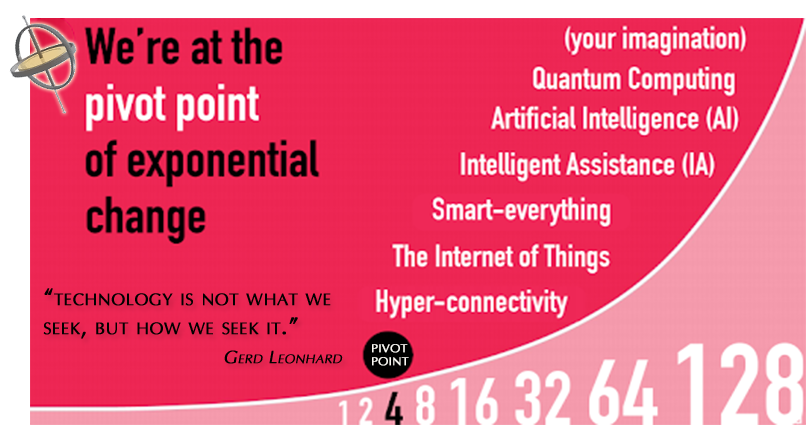

Disruption is ever-present in this new normal. Change has stopped happening gradually and it now happening exponentially as everything that was dumb and disconnected is now wired and intelligent. The next 20 years will change faster than the last 300 years.

Increasingly, science fiction is becoming science fact. Exponential technologies are rapidly changing our lives and societies, every day and everywhere. Everything from smartphones to home appliances, cars, cities, and ports, even our bodies will be wired.

One such example is that Elon Musk believes he can merge our minds with machines. His new venture called Neuralink is a thin mesh device that is inserted into the skull that is then connected to the internet so we can upload our brains and become superhuman. Really! He’s done some great things but I’m not sure this is a good thing for humanity.

Musk suggests it’s a way of gearing up, but we don’t have to compete with technology in becoming technology. We can embrace it and as Gerd Leonhard, a futurist speaker says, “technology is not what we seek, but how we seek it.”

Adapted by Gerd Leonhard

Two Primary Keys Go Hand In Hand

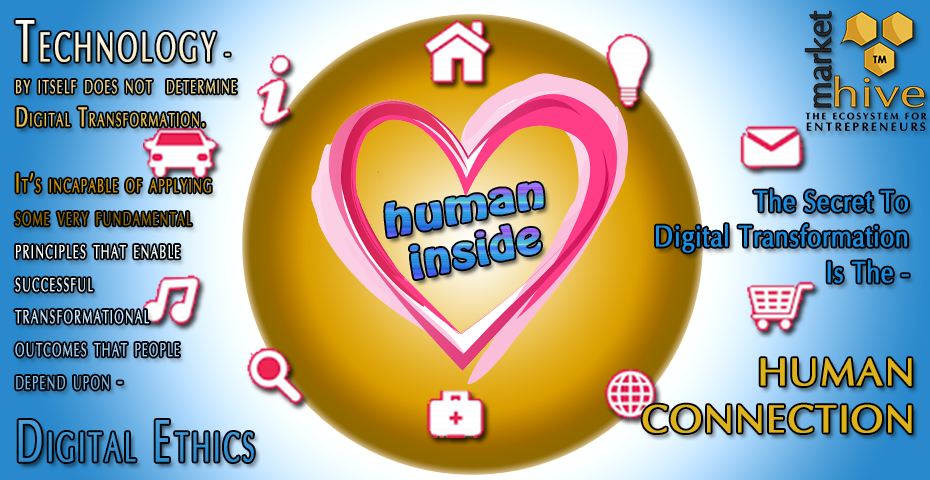

So this has created a new paradigm. The biggest innovation needed to be realized is that we need to go from dehumanization to re-humanization and have a different purpose. Not just profit, growth, jobs, and GDP, but people, planet, purpose, and prosperity. Technology is the key to this and the other key is ethics.

Technology can do great things but someone has to decide what those great things are. Technology drives our future, but ethics defines it. I think it’s safe to say algorithms know the logic of everything but the feelings of nothing. It can’t comprehend emotional intelligence, so we need to invest as much in humanity as we do in technology.

Quantum computing fuels big data and the internet of things (IoT) fuels artificial intelligence and deep learning which in turn fuels robotics, however anything that cannot be digitized or automated will become extremely valuable. Human-only traits such as creativity, imagination, intuition, emotion, and ethics will become more important in the future because machines are very good at simulating, but not good at “being”.

Robots and software will take over some of our work, but this allows us to focus on things that cannot be automated. Technology is defined by automation, even knowledge is automated… just need to Google it. But what cannot be automated is understanding that knowledge. That requires human perception. If we go beyond technology and data to reach human insights and wisdom, only then, will we have a perfect balance.

How And Why = Holistic

Technology represents the “How” of change and humans represent the “Why”. The future is about holistic business models and the opportunity is to be liquid, learn, and be one step ahead of the inevitable. This will take complete transformations, not just single improvements, with a focus on new ecosystems, not individual systems.

The future is in our hands today, it’s not tomorrow. The future is not a time frame, it’s a mindset. There has been a boom in technology over the last 4 years and it seems in the last few months technology has come out on top, given the COVID-19 situation with the surveillance tools now being implemented. This crisis is a test of our humanity. The more we connect with technology the more we must protect what makes us human.

Humanity is where true and lasting value is created as we engage, relate, and buy things because of the experiences they provide. The new way to work is to embrace technology, but not to become it. The future is in technology, but the bigger future is in transcending it.

As I said before, technology drives our future, but ethics defines it. This is what went wrong with Facebook as it has been ethically irresponsible and said to be destroying the very fabric of human relationships by inciting anger amongst the users due to the threat of democracy and its censorious nature. The real damage being done is to people’s mental health, to a cohesive and functional society, and to free speech itself.

Also, it has been documented that “data is the new oil”, but given the lack of ethics with data harvesting, it can also be addressed as “data is the new plutonium”. It can be used as a weapon.

“Ethics is knowing the difference between what you have a right (or the power) to do and what is the right thing to do.” – Potter Stewart.

Free here : Click here

The Heart Of Digital Transformation

We need different skills, and we need to be comfortable and effective with driving change, or we will be driven by it. One company that is driving transformational change in the social media, marketing network sector is Markethive. Here we get to enjoy our autonomy and free speech along with a sustainable balance between technology and humanity.

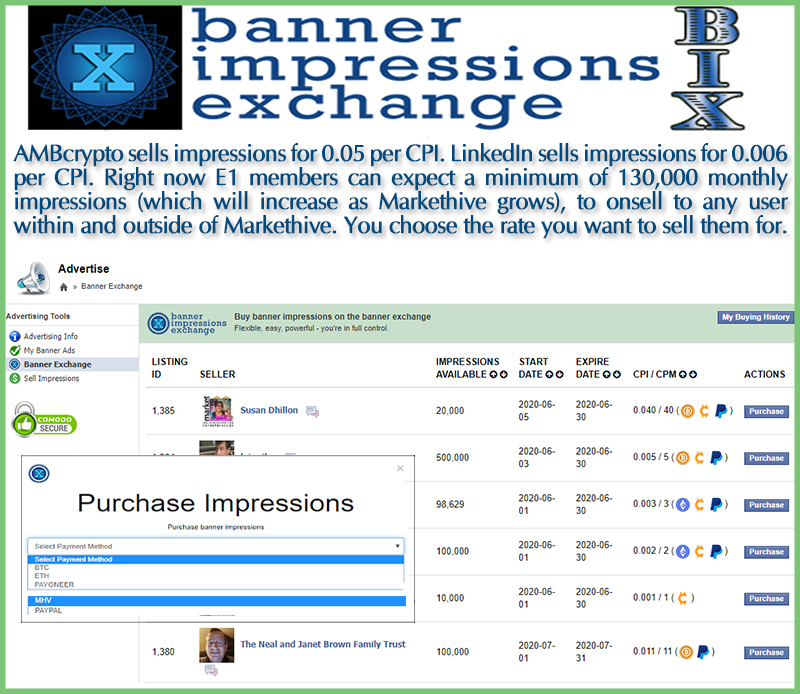

Digital transformation is a process, not a destination. It’s not a workaround adding technology on top to an existing company, it’s a total re-work. It’s where systems and infrastructures are designed to be digital and can scale seamlessly and thrive in that domain. Markethive has been built and rebuilt from the ground up, starting off with blockchain technology and cryptocurrency.

The very fabric of Markethive is it’s collaborative and entrepreneurial nature of the community. Markethive’s culture is not fixed, but a decentralized, autonomous, fluid environment that is founded, built, operated, and used by entrepreneurs. It is self-governing, independent, and sovereign by design with a culture of innovation. It is the personification of Digital Transformation.

Integrated with state-of-the-art blockchain, cryptocurrency, inbound marketing, and decentralized database technologies, Markethive has constructed a social market network that provides a “Universal Income” created exclusively with entrepreneurs in mind and will benefit greatly from its ultimate success.

Free here : Click here

What to date has become the “norm” of social platforms having full access to your private and other data to use for their benefit is over. Your voice is yours, and yours alone, and you should benefit from it as well as your work and success you achieve through the Markethive platform.

There are so many facets to Markethive. This is a mammoth undertaking and a continuous one. For as long as technology evolves so will Markethive along with the humanity within it. Check out the Markethive Blog Section which segments the many components of this complete Entrepreneurial ecosystem to understand what we have here.

From the Visionary, Founder and CEO and of Markethive, Thomas Prendergast,

“Look beyond the looking glass. Markethive is not just this Newsfeed. But this Newsfeed is unique and the portal to the unlimited power of Markethive.”

Conclusion

Markethive’s continuous objective and mission are to provide a social environment, complete with an arsenal of technology, that champions the rise of the entrepreneur. We should embrace technology but not become it or be overcome by it. Anything that can be digitized or automated, will be, and anything that cannot be digitized or automated will become extremely valuable. Markethive with its collaborative community goes beyond technology and defines the real human values in this new digital ecosystem. Digital ethics is Markethive’s key differentiator.

Join us at our weekly webinars on Sundays at 10 am (Mountain Time) to stay informed of Markethive’s evolvements as they happen. Witness the true collaboration and heart of Markethive and its members. The link to join the meetings can be found in the Markethive calendar. See You there!

Resources: Ionology, Gerd Leonhard

Free here : Click here

Deb Williams

A Crypto/Blockchain enthusiast and a strong advocate for technology, progress, and freedom of speech. I embrace "change" with a passion and my purpose in life is to help people understand, accept, and move forward with enthusiasm to achieve their goals.