Will the Disinflation of Bitcoin Lead to Long-Term Price Surge?

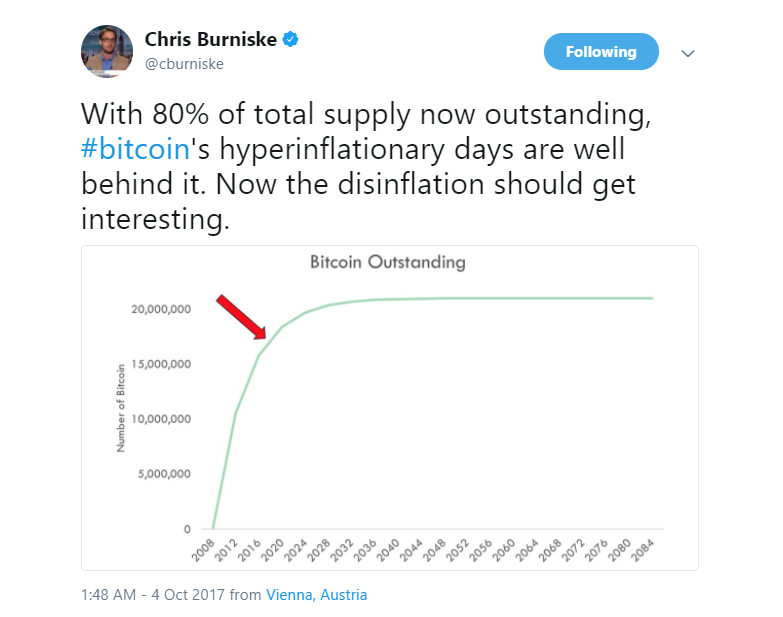

Chris Burniske, a parter at cryptocurrency-focused venture capital firm Placeholder and former cryptocurrency investment lead at ARKInvestment, revealed that 80 percent of the total supply of bitcoin is now outstanding and that its hyperinflationary period is behind it.

Dissimilar to most currencies and assets, bitcoin is a deflationary currency because of its unique monetary policy. Since its introduction in 2009, bitcoin was structured specifically to operate as a robust and secure store of value, and as an alternative to existing banking systems, financial networks, and currencies.

Two distinct characteristics of bitcoin which sets it apart from bank-issued or operated currencies are its decentralized nature and fixed supply. Bitcoin’s supply is capped at 21 million and consequently, it is not possible for more than 21 million bitcoin to exist.

Disinflation and Decreasing Supply of Bitcoin

Because there will only be 21 million bitcoins and no additional bitcoin can be created after the supply achieves its cap, only a limited number of investors would be able to hold one full bitcoin.

Chris Burniske, a parter at cryptocurrency-focused venture capital firm Placeholder and former cryptocurrency investment lead at ARKInvestment, revealed that 80 percent of the total supply of bitcoin is now outstanding and that its hyperinflationary period is behind it.

bitcoinDissimilar to most currencies and assets, bitcoin is a deflationary currency because of its unique monetary policy. Since its introduction in 2009, bitcoin was structured specifically to operate as a robust and secure store of value, and as an alternative to existing banking systems, financial networks, and currencies.

Two distinct characteristics of bitcoin which sets it apart from bank-issued or operated currencies are its decentralized nature and fixed supply. Bitcoin’s supply is capped at 21 million and consequently, it is not possible for more than 21 million bitcoin to exist.

Disinflation and Decreasing Supply of Bitcoin

Because there will only be 21 million bitcoins and no additional bitcoin can be created after the supply achieves its cap, only a limited number of investors would be able to hold one full bitcoin.

But, bitcoin’s deflationary supply is not an issue for investors and merchants that adopt bitcoin as a digital currency because it is divisible. Currently, many bitcoin wallets and merchants use “satoshi” as a unit, with one satoshi representing 0.00000001 bitcoin.

At the Texas Bitcoin Conference, economist Robert Murphy from the Austrian School of Economics, refuted the criticism of conventional economists that previously condemned the monetary supply of bitcoin. Murphy stated:

“Part of where this fear of deflation comes from is, historically, it’s associated with very bad economies. So, during the Great Depression of the 30s, there were falling prices. And there are other periods where prices fell when things were bad, but I would argue that the causality was the other way around. Partly what was going on there was people were concerned because the economy was so terrible. And, so what do you do when you’re afraid? You don’t want to invest in companies and things like that. You rush to liquidity. You rush to hard money. That’s why you often see in periods of panic people will rush to the money, so you see prices of all other things quoted in money fall. So, it’s not that the falling prices caused the bad economy. It’s the other way around.”

The deflationary monetary policy of bitcoin will only increase the demand for bitcoin in the long-term. As noted by Burniske, already 80 percent of bitcoin’s supply is outstanding and the creation of bitcoin will be limited as years pass, upon the “halving” of miner reward.

If Bitcoin’s Current Rate of Growth is Sustained, its Value Will Increase Drastically

Several analysts including RT’s Max Keiser, Harvard academic Dennis Porto, and Saxo Bank senior analyst Kay Van-Petersen have provided a strong case of the bitcoin price surpassing $100,000 within the next ten years. In order for bitcoin to achieve $100,000 in value, its market cap would need to increase beyond $2.1 trillion.

Currently, many investors and traders have invested in bitcoin as a safe haven asset and a long-term investment. But, as bitcoin evolves as a technology and a robust financial network, it will soon compete with reserve currencies, existing banking systems, and traditional assets such as gold.

For the long-term growth of bitcoin’s market cap and price, its deflationary nature will be a vital factor to sustain bitcoin’s upward momentum and demand for bitcoin from the global market.

Author: Joseph Young on 07/10/2017

Posted by David Ogden Entrepreneur

Alan Zibluk Markethive Founding Member