Looking Ahead To $20,000 Bitcoin

In last week’s Investor Alert, our investment team shared with you a report from Morgan Stanley that says Bitcoin’s price decline since December mimics the Nasdaq tech bubble in the late 1990s. This isn’t earth-shattering news in and of itself. The main difference is that the bitcoin rout happened at 15 times the rate as the tech bubble.

Morgan Stanley has some good news for Bitcoin bulls, however: The 70 percent decline is “nothing out of the ordinary,” and what’s more, such corrections “have historically preceded rallies.” Just as the Nasdaq gained back much of what it lost in the subsequent years—before the financial crisis pared losses even further—bitcoin could similarly be ready to stage a strong recovery.

One research firm, in fact, believes Bitcoin and other digital coins, or “alt-coins,” have likely found a bottom. New York-based Fundstrat, headed by strategist Thomas Lee, issued a statement to investors last week saying that, though a cryptocurrency bull market isn’t necessarily underway, the worst of the pain could be “largely over.”

Fundstrat research shows that periods of cryptocurrency consolidation, or “purgation,” generally last 70 to 231 days. Bitcoin hit its all-time high in mid-December, almost 70 days ago as of March 26. Taking into consideration Fundstrat’s estimates, then, it’s possible the bear market could conclude sometime between now and early August.

In the meantime, Lee writes, alt-coin investors should stick with larger-cap cryptocurrencies such as Bitcoin, Ethereum and Ripple.

Take the Long-Term View

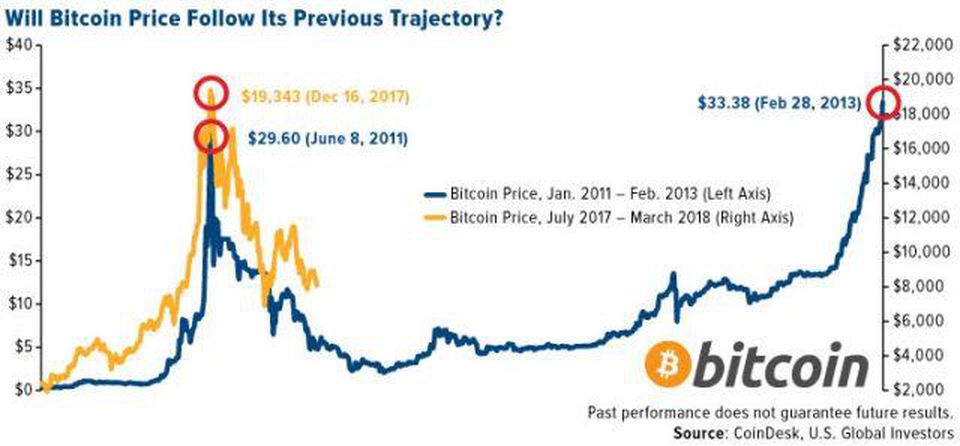

It’s helpful to compare Bitcoin with Nasdaq, as Morgan Stanley did, but what about comparing the current cycle with one from the past?

In June 2011, Bitcoin peaked at nearly $30 and found a bottom of $2.02 five months later, in November. It would be an additional 15 months before it returned to its former high. This might seem like a long time to some, but investors who managed to get in at the bottom would have seen their position grow more than 1,300%.

So can Bitcoin do the same today? Obviously no one can say for sure, but what I can say with certainty is that Bitcoin, like all digital coins, is highly volatile. Plus, there’s not quite 10 years’ worth of data, meaning it’s been difficult to identify trends.

Cryptocurrencies are also currently facing tougher oversight from several world governments and central banks, not to mention Facebook and Twitter’s bans on ads promoting them—obstacles they didn’t have to contend with back in 2011 and 2012.

But I remain bullish. Cryptocurrencies are still in their very early stages. To return to the comparison with tech stocks, we don’t know at this point which digital coins will be tomorrow’s equivalent of Amazon, Google, Apple and Facebook. A long-term view is key.

Finally, I still believe in the power of Metcalfe’s law, which says that as more and more people adopt a new technology—cell phones, for instance, or Facebook—its value goes up geometrically. A poll conducted in February shows that just under 8% of American adults report ever owning or purchasing any cryptocurrencies. Market penetration, then, hasn’t been as pervasive as some might expect, but as people increasingly become more confident in dipping their toes in the space, demand could rise and, with it, prices.

Author Frank Holmes

Posted by David Ogden Entrepreneur

Alan Zibluk Markethive Founding Member