Is Bitcoin or Other CryptoCurrency a Good Investment

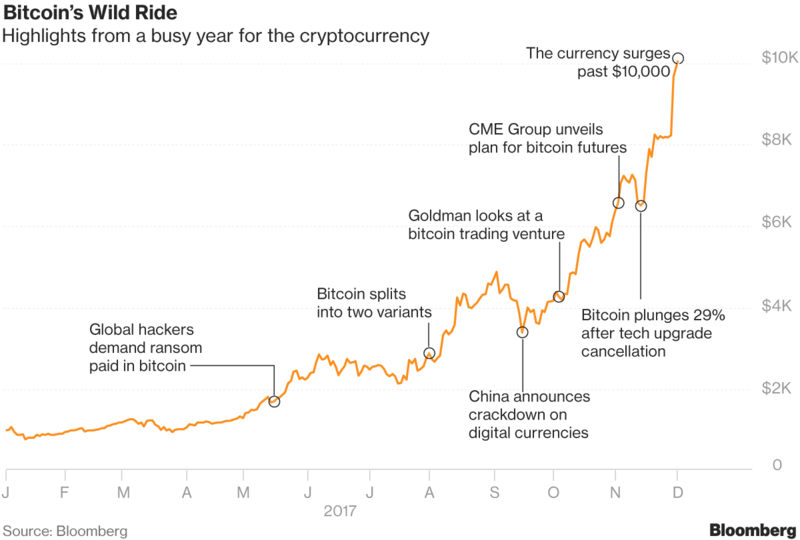

Despite all denials of the techies, the Bitcoin continues to fly under the pressure of marketing that makes it a form of Russian roulette that benefits those who know the manipulation. Since March 26, the Bitcoin has increased from $ 973 to $ 2,795. A real explosion of prices which can only be explained by fraudulent maneuvers. It went from $ 16 billion to $ 43 billion.

But behind this surge, there are formidable manipulators who have means that are the exchanges of bitcoins of which several leaders are in prison. The founder of the world’s largest depository based in Bitcoins, now based in Zug, Switzerland, predicts that the value of a Bitcoin will surpass the million dollar mark in 10 years, taking by surprise the whole assembly and even the most Optimists in the sector. Some see the replacement of gold. We are in full delirium.

On several occasions, these dramatic increases came from the conversion of dirty money into Bitcoin. We do not know what causes these mood swings that fall quickly. Do they pose a fundamental question: Beyond the technology behind the object, from where comes the value of $ 32 billion?

No regulation of false rumors or manipulations

There is a lot of talk about the Bitcoin right now, as well as a few other crypto-currencies, but are they really good investments? Recently I read research which describes why Bitcoin are a good investment for the future. They also provide detailed analysis and data to showcase their study. So I am exploring based on that and my personal opinion on crypto-currencies.

I will divide this question into three points:

1. Are crypto-currencies really an investment?

2. What currency crypto choose?

3.Are crypto-currencies really an investment?

Nowadays, virtually everything is called an “investment”. In the case of crypto-currencies, trading (trading) and investment are again confused, even by financial professionals.

An investment is when you buy an asset that produces something, and that by extension creates income.

For example, if you buy a tractor and lease it, it will allow someone to dig to then put the foundation of a house, pull farm machinery, and much more. In exchange for the productivity of your assets, you receive an income.

The question is, therefore: does the crypto-currency produce something?

The main added value of crypto-money is that it can make anonymous transactions, so it increases economic activity (albeit generally illegal).

That said, it produces nothing tangible for you because its overall productivity is drowned in the pool of all transactions.

Your only hope is therefore that its overall productivity in the form of a currency function is growing so that you can “freak out” your crypto-currency.

Basically, crypto-currency does not produce income for you, and your only option to make money is that its demand increases.

When a profit is generated not by production but by the difference between the purchase price and the selling price, it is called trading and not an investment.

What does it actually mean that it is trading and not an investment?

Trading is speculation and it’s not complicated, 95% of people lose at this activity.

Investing is a much safer way to get rich. You simply need to be aware of what you are doing with your money, and not speculate in thinking that you are investing.

Which crypto-currency to choose?

Bitcoin? Zcash and Zcoin? SafeCoin? Syscoin?

Admitting that you understand that you are speculating, the only crypto-currency I would negotiate personally is the Bitcoin, for two reasons:

Reason # 1: Everyone knows the Bitcoin

This point seems banal and simplistic. However, it should not be forgotten that the value of crypto-currencies is based on people’s trust. Indeed they are “fiat currencies”, like the Canadian dollar, the US dollar, and virtually all currencies in the world.

People have a tremendous confidence in the Canadian dollar and particularly the US dollar, which is the world’s reserve currency. What about crypto-currencies?

How do people trust you, the Bitcoin, the Zcoin, or the Syscoin? Obviously, people have more confidence in the Bitcoin, and one can easily assume that it will only go by increasing over time.

However, there is always resistance, and people do not have enough confidence in the Bitcoin to move away from the Canadian dollar or the US dollar.

In particular, the critical point or the Bitcoin could explode in price is when people will have enough confidence to use another function of the currency: the reservoir of value.

When people have confidence in Bitcoin to use it as saving, as an entity where they can retain the value of their work, then everything will change.

But how could the Bitcoin reach this level? How to develop this trust? These questions lead me to the second reason.

Reason # 2: The Bitcoin is the only crypto-currency that has a real chance

The Bitcoin is the only crypto-currency that has a real chance of what? To become an official currency, endorsed by the government and the financial system.

A strong and unshakeable confidence in the Bitcoin can only exist if governments and the financial system give it their approval.

In fact, it seems that in Canada the government is increasingly ready to incorporate the Bitcoin into daily transactions. This is not cast in concrete, and the future is still vague at the legislative level.

One of the barriers to official currency status for Bitcoin is that the government cannot legalize a private currency, which would limit its ability to tax transactions.

Can another crypto-currency based on the blockchain possibly be adopted rather than the Bitcoin? Yes, but precisely, there lies the whole aspect of speculation: we must try to predict the future.

In summary, invest in crypto-currencies or not?

Honestly, the majority of people do not even have $ 2,000 in an emergency, according to an article I read, so I do not see myself buying Bitcoins.

In this situation, I would buy stocks, bonds, gold, and real estate well before buying Bitcoins.

So unless I have a full RRSP and a TFSA, stuffed with income-producing assets, I cannot justify buying crypto-currencies.

I understand the desire to hit a home run with the Bitcoin, the desire to make 10 times his initial bet. This may be suitable for some people, but I cannot endorse this strategy because it makes a lot more losers than winners.

The strategy to get rich that works for me and in general is to get rich in the long run, walking by walk, so surely find myself at the top of the stairs.

Aashish Sharma

Aashish Sharma

The article above is quite interesting but many people do not realise you do not need to to purchase a wholw bitcoin, there are ways and means to earn bits for free completing surveys, or by investing in Trade Coin Club

David Ogden

Entrepreneur

Alan Zibluk Markethive Founding Member